Iran’s construction materials market has demonstrated notable dynamics in recent years, with export and import data revealing critical trends and opportunities for domestic and international players. In 2022, Iran exported $930.6 million worth of stone and glass, marking a 6.5% increase from 2021. Similarly, wood exports grew by 9.4%, reaching $276.6 million. However, metals saw a slight decline of 6.4%, dropping from $11.57 billion in 2021 to $10.82 billion in 2022. These figures highlight the sector's resilience amidst global economic challenges, particularly for high-demand materials such as stone, glass, and wood.

On the import side, the data reveals a significant reliance on external suppliers for specific materials. Wood imports surged by 27.6% year-over-year, reaching $1.88 billion in 2022, indicating strong domestic demand and potential supply chain gaps. Similarly, metal imports grew by 25.2%, totaling $3.19 billion. While Iran has a robust export portfolio for certain materials, its dependency on imports for others creates opportunities for foreign suppliers to penetrate the market, especially in niche segments like high-quality timber and advanced glass products.

The construction sector in Iran is further bolstered by its urbanization trends and infrastructure development. With 76.8% of the population living in urban areas and an annual urban growth rate of 1.8%, the demand for construction materials such as cement, rebar, and ceramic tiles is expected to rise steadily. Additionally, Iran’s population density increased to 55.2 people per square kilometer in 2022, driving higher construction activity in urban agglomerations. These factors create a promising landscape for both local manufacturers and international exporters seeking to expand their footprint in the region.

Despite these opportunities, challenges persist. Sanctions, currency fluctuations, and supply chain disruptions have impacted material availability and pricing. For example, while Iran’s cement production capacity remains robust, logistical barriers have limited its export potential. Similarly, wood and timber imports face tariffs that can deter foreign suppliers. Businesses looking to enter the Iranian market should consider these hurdles and explore strategies to mitigate risks, such as leveraging local partnerships or investing in localized production.

To address these complexities and unlock market potential, platforms like Aritral.com provide invaluable support. Aritral.com is a B2B online marketplace that streamlines global trade for construction materials suppliers and buyers. The platform offers features such as detailed product listings, AI-powered international marketing, and global trade assistance, enabling suppliers to showcase products like brick, plaster, cement, sand, and ceramic tiles to a worldwide audience. With direct communication tools and automatic translations, Aritral eliminates language barriers, making it easier for businesses to connect with Iranian buyers. Additionally, sellers can utilize professional business profile management and AI insights to optimize their export strategies.

For instance, a supplier of rebar or concrete blocks can use Aritral’s tailored solutions to place purchase requests or submit sales offers, ensuring maximum visibility in Iran’s growing construction market. Whether you are an exporter of lime, paint, or timber, Aritral.com provides the tools needed to navigate the complexities of international trade and capitalize on Iran’s evolving demand for construction materials.

In conclusion, Iran’s construction materials market presents a mix of opportunities and challenges shaped by trade dynamics, urbanization trends, and economic barriers. Businesses that adopt data-driven strategies and leverage innovative platforms like Aritral.com are better positioned to succeed in this competitive landscape.

-

Shahriar Block 3 months ago

Shahriar Block 3 months ago Iran

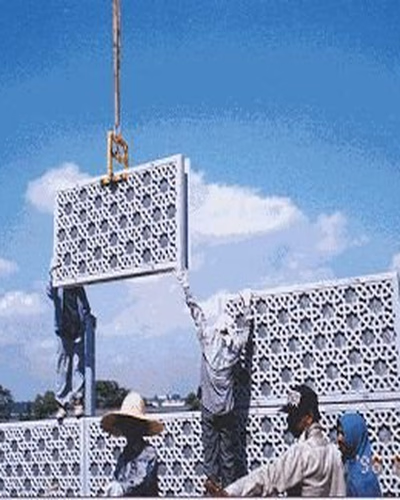

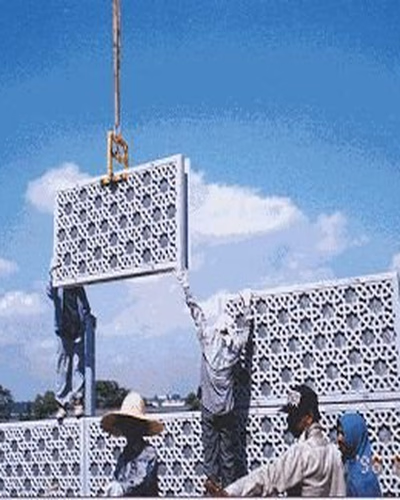

Lightweight Cement Blocks

Iran

Lightweight Cement Blocks

Receive guaranteed quality blocks from Shahriar Block. كتلة عالية الجودة مع كيفية تضمين الكتلة مع كتلة شهريار. High quality block with how to include ...Details

-

نوآوران برتر آسیا 3 months ago

نوآوران برتر آسیا 3 months ago Iran

Electrical Tape Cutting and Packaging Machine

Iran

Electrical Tape Cutting and Packaging Machine

Production and manufacturing of various machines and equipment for producing, cutting, and packaging electrical tape Supplying high-quality raw materi...Details

-

Sheikh 3 months ago

Sheikh 3 months ago Iran

Marble Stone

Iran

Marble Stone

Hello Marble stone available in various sizes without limitation in tonnage for export to all countries. It is possible to barter with property, land,...Details

-

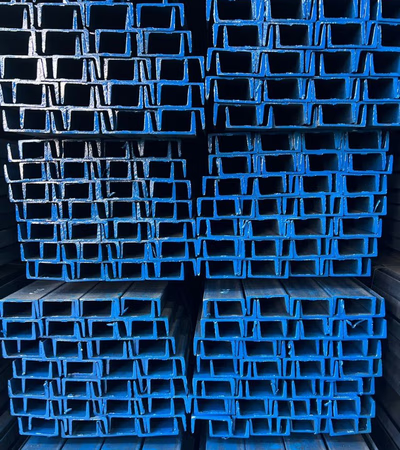

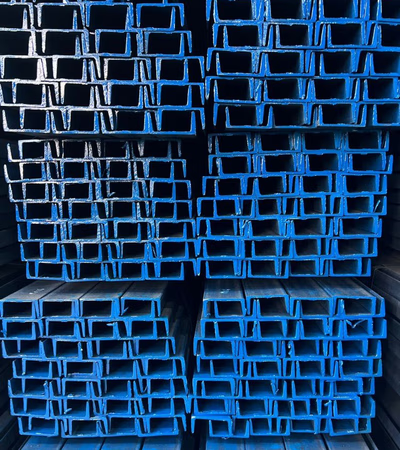

Samazakeri 4 months ago

Samazakeri 4 months ago Iran

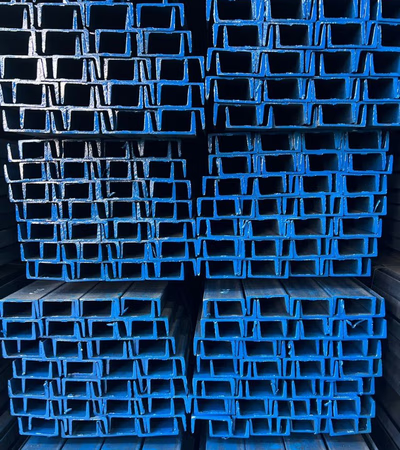

Anything you want. . we are producing steel angle and channel and we can export these products

Iran

Anything you want. . we are producing steel angle and channel and we can export these products

Anything you want.Details

-

ایتای 3 months ago

ایتای 3 months ago Iran

XPS Foam

Iran

XPS Foam

XPS thermal insulation foamDetails

-

Mina Ekhtiyar 2 months ago

Mina Ekhtiyar 2 months ago Iran

steel angle and channel

Iran

steel angle and channel

hello , we are producing steel angle and channel and we can export this products , for many explain please text me in wtpDetails

-

شمش آهن و میلگرد 3 months ago

شمش آهن و میلگرد 3 months ago Iran

Export of iron billets and rebar and aluminum and urea and sulfur and cement

Iran

Export of iron billets and rebar and aluminum and urea and sulfur and cement

We at the export and import trade office are capable of supplying iron billets and rebar as well as aluminum and copper billets, and also supplying ce...Details

-

Kani Sarv Paya 2 months ago

Kani Sarv Paya 2 months ago Iran

Granite Stone

Iran

Granite Stone

Kani Sarv Paya Company operates in the field of exporting Marsh, Amazon, and Granada stones to the whole world.Details

-

Seyed Mohammad Fazeli 3 months ago

Seyed Mohammad Fazeli 3 months ago Iran

Gemstones, Building Materials, Minerals

Iran

Gemstones, Building Materials, Minerals

Holder of various mines of stone, gypsum, cement, and wood and construction industries.Details

-

Javad Hosseini 3 months ago

Javad Hosseini 3 months ago Iran

White Talc. Quartz. Silica. Chromite. Dolomite

Iran

White Talc. Quartz. Silica. Chromite. Dolomite

Hello My business is related to the sale and export of Afghan white talc, chromite, dolomite, quartz, silica, zinc soil, copper soil, iron soil and pe...Details

-

Iran Zamin Tejarat 3 months ago

Iran Zamin Tejarat 3 months ago Iran

Various bricks, various rebars, various cements, various tiles and ceramics, various building facade stones, various Heblex, various Leca blocks,

Iran

Various bricks, various rebars, various cements, various tiles and ceramics, various building facade stones, various Heblex, various Leca blocks,

Trade of building materials (various bricks, various rebars, various cements, various tiles and ceramics, various building facade stones, various Hebl...Details

-

Bāzargānānī Mahdi Nouri 3 months ago

Bāzargānānī Mahdi Nouri 3 months ago Iran

Scrap Iron, Scrap Metal, Tubes and Profiles

Iran

Scrap Iron, Scrap Metal, Tubes and Profiles

Mahdi Nouri Trading operates in the following goods: Rebar Tubes and Profiles Iron Scrap Dried Fruits Spices Tiles and CeramicsDetails

-

Mehdi 3 months ago

Mehdi 3 months ago Iran

Various building materials including cement, gypsum, blocks, and Hebel. Various iron products and rebar. Various fertilizers, seeds, and pesticides.

Iran

Various building materials including cement, gypsum, blocks, and Hebel. Various iron products and rebar. Various fertilizers, seeds, and pesticides.

Fertilizers, seeds, and pesticides. Various building materials. Various iron products and rebar.Details

-

Almas Astone 5 months ago

Almas Astone 5 months ago Iran

Export of all stone building products

Iran

Export of all stone building products

Production of various stone building products. Internal wall panels, external facade, production of various artificial stones including nano cement pl...Details

-

Ali Diabi 3 months ago

Ali Diabi 3 months ago Iran

Building Stone

Iran

Building Stone

I am an exporter of building stones to European and Asian countries.Details

-

Arvandab Company 3 months ago

Arvandab Company 3 months ago Iran

Dual-purpose toilet paper holder

Iran

Dual-purpose toilet paper holder

🔹 Advantages of the Prime Arvandab model tissue holder:🔸Dual-purpose device with two separate tissue outlets (roll and sheet) 🔸Arvandab lifetime guara...Details

-

Kompani Shyvayi 3 months ago

Kompani Shyvayi 3 months ago Iran

Scorpion venom, quality ceramic tiles, all kinds of construction doors, white and red apples

Iran

Scorpion venom, quality ceramic tiles, all kinds of construction doors, white and red apples

In the year, we are able to supply 2 liters of scorpion venom for medical purposes, we provide the highest quality tiles and ceramics with a wide vari...Details

-

Rozhan Tejarat Sirvan 2 months ago

Rozhan Tejarat Sirvan 2 months ago Iran

Luxury Clinker Cement Stones and Steel Products

Iran

Luxury Clinker Cement Stones and Steel Products

Building Stones (Travertine, Granite, Marble): These natural stones are widely used in construction due to their durability, aesthetic appeal, and res...Details

-

Seyed Ahmad Hashemi 3 months ago

Seyed Ahmad Hashemi 3 months ago Iran

Royal Marble Stone Masonry

Iran

Royal Marble Stone Masonry

Sales of Royal Marble from Shahrekord in export dimensionsDetails

-

Nooshin Khoddami 2 months ago

Nooshin Khoddami 2 months ago Iran

Iranian Goods

Iran

Iranian Goods

Dorrin company is ready to deliver all the mentioned goods in the shortest time at the best price at the entry points of Asian and Middle Eastern coun...Details

-

Sima Star Company 3 months ago

Sima Star Company 3 months ago Iran

Price and Purchase of Various Ceramic Tiles Directly from the Company

Iran

Price and Purchase of Various Ceramic Tiles Directly from the Company

Selling all kinds of ceramic tile products and shipping to all parts of the world. Ability to produce and manufacture products required by customers. ...Details

-

Hamid Taj Mohammadi 3 months ago

Hamid Taj Mohammadi 3 months ago Iran

Fossil

Iran

Fossil

Fossil stone resembling a monkey skullDetails

-

Ali Ghazalbash 2 months ago

Ali Ghazalbash 2 months ago Iran

Building Stone

Iran

Building Stone

All building and decorative stonesDetails

-

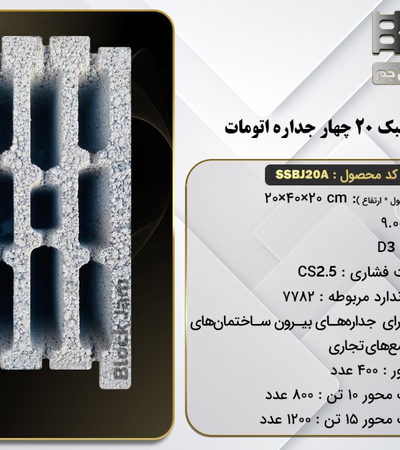

Pumice Standard Block Jam Production Group 3 months ago

Pumice Standard Block Jam Production Group 3 months ago Iran

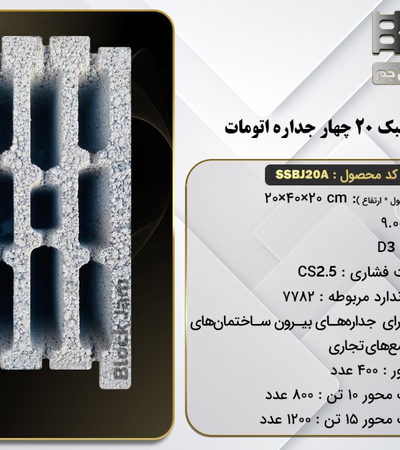

cement standard block+pumice standard block

Iran

cement standard block+pumice standard block

Standard light block ( is one of the best and most widely used building materials for wall cladding. Very high strength (due to the use of fully autom...Details

-

Ma'dan Sang Darb Chah Iran Lorestan Khorramabad 7 months ago

Ma'dan Sang Darb Chah Iran Lorestan Khorramabad 7 months ago Iran

Limestone Building Facade Stone Iran

Iran

Limestone Building Facade Stone Iran

Sales of various facade stonesDetails

-

Masoud Bahrami 7 months ago

Masoud Bahrami 7 months ago Iran

The Stone Facade of the Jewel Building in Iran Lorestan Borujerd. Gemstone Facade Construction of the Jewel in Iran Lorestan Borujerd

Iran

The Stone Facade of the Jewel Building in Iran Lorestan Borujerd. Gemstone Facade Construction of the Jewel in Iran Lorestan Borujerd

Gemstone Facade of the Jewel in Iran Lorestan for sale (selling various types of stone) facade of the Jewel Building in LorestanDetails

-

Sena Sang 2 months ago

Sena Sang 2 months ago Iran

Gemstones

Iran

Gemstones

Cutting and making various types of gemstones, agate, and ringsDetails

-

Bazargani Mana Nik 2 months ago

Bazargani Mana Nik 2 months ago Iran

Ceramic Tiles

Iran

Ceramic Tiles

Tiles and ceramics can be produced with the customer's specified brand.Details

-

Jolfa Tejarat Rahim Aras 2 months ago

Jolfa Tejarat Rahim Aras 2 months ago Iran

Various Types of Building Materials and Dry Goods

Iran

Various Types of Building Materials and Dry Goods

Exporting various types of steel with the shortest loading time and timely delivery at the lowest pricesDetails

-

Sherkate Isasanat Mahna Shomalgharb 3 months ago

Sherkate Isasanat Mahna Shomalgharb 3 months ago Iran

Tile and Ceramic Leveling

Iran

Tile and Ceramic Leveling

Tile and Ceramic Leveling With high quality and the lowest price Produced in Ardabil, Iran Clip 1mmDetails